|

0 Comments

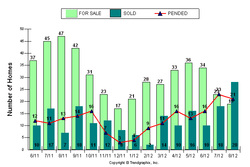

Local Voices David Melford Preservation Realtor, Community minded individual Consistent San Marino Residential Real Estate MarketPosted on December 3, 2012 at 2:17 am Comment San Marino Home sales and listing activity has remained consistent over the last 2 quarters as we have had a steady growth across the country for many months, even with the drop of inventory as much as 13%, from Realtor.com 3rd QTR Report. In San Marino the inventory, reported from iTech MLS has remained the same; 12 active on the market, another dozen in back-up position or in escrow and guess what? more sold inventory than both active & in escrow combined (26 closed) since June 2012. What’s interesting is active inventory is over $700 per sq ft and what has sold is consistent with pending status sales close to $590 per sq ft. That’s ½ the sold inventory selling at above and below list price, so the average is about 98% sold to list price, not bad. A strong market for San Marino. Here is what is listed for San Marino in the LA Time Data Quick News: San Marino 91108 October 2012 Sales 17 Median $1,700,000 from 10/2011 21.4% Med. Home $612/sq ft Compare that to the rest of LA County where homes are up 13.3%, it may appear to be weak, but remember, San Marino has no Foreclosure sales since June and only 1 home in escrow that is reported as a “short sale”, no bank owned properties. According to Foreclosure Radar, there’s only 3 pre Foreclosures and 2 homes slated for auction, which is ½ the activity that usually is reported. That means The economy is improving. However, unemployment is still high, where according to Realtor.com, the highest in Fresno is 14% and the lowest reported in the state of California is as low as 8.2% in Oakland and San Francisco, where the change in Housing Inventory dropped to 40 and as much as 58% for the 3 QTR compared to last year. That spells “turnaround” when people want to buy with tight inventory. What we need to keep watch for is the Fiscal Cliff. Homeowners cannot afford to have caps or closed “loopholes” for Mortgage Interest Deductions or Capital Gains, that is not good for consumer confidence or home buying. Protect the MID from Congress if you can.  After yesterday's announcement by Fed Chair Bernanke regarding interest rates to remain low to boost the economy, Stocks rose to a high not seen since 2007, however newscasters suggest it's like a "sugar rush" and what we need is a more nutritious diet for the economy. Consumer confidence always fluctuating between job numbers and average incomes announced, the bottom-line for Real Estate is "inventory", which is still low. In our area of the San Gabriel Valley, based on the latest 3rd quarter report from TRENDVISION San Marino has kept strong a minimum of 585 $/sq ft and number of sold up 55%, which is consistent, but not the jump in sales 15 mos. ago. View Listings The inventory is still down, nearly 20% for 17 active, 8 back-up, pending-sale listings taking 30 - 60 days on market, where it takes 90 -120 days to close from list to closing time total. That's still an under-supply of inventory with close to a 1 month absorption rate. Properties here are going into contract fast and based on the financing and often with so many investors in line to buy, all cash. It's no wonder there's a lack of inventory. More and more investors see the sugar rush and buy properties instead of other markets. From $950, 000 to $5M offered in San Marino, in our neighboring town South Pasadena, View Listings, There are just as many listings active on the market as well as in escrow, however for the same period from March - September 2012, three to four times as many Homes sold (59 vs. 17) or close escrow. The affordability however was 1/2 of San Marino, where South Pasadena prices offered now are $410,000 - $1.7M. Lastly Foreclosures. Yes, they are down Nationwide, California 3rd highest nationwide, San Gabriel Valley, big drop, where San Marino; 2 Trustee Sales (will likely be delayed/cancelled) and 4 NODs filed, or those that might be 3 months late with the bank. South Pasadena 16 properties ready for a likely delayed Trustee Sale (Auction) and 10 in pre-foreclosure. Only 1 REO (bank owned) in South Pasadena. Nothing in San Marino owned by the bank, except for investor owned (repossessed) 1-2 years ago at Garfield/Huntington (was a bank) and north/east corner of Huntington/Waverly; where that is now new developed home. http://www.npr.org/templates/story/story.php?storyId=160207038

With such a mixed bag of market news, it seems, at least Nationwide we are out of the “bottom” of the market. There’s a big change in real estate multiple listing reporting with more than triple the number of combined listings that are combined status in “active”, “Back-up” and “pending” compared to those sold in the same period, yes there’s a shortage of inventory, however there’s a bit of time to close sales. Depending on what city, that can vary on the absorption rate from 2 – 4 months and especially if we are talking about short sales. In San Marino and South Pasadena, it’s much shorter to close. The mortgage interest rates are attracting so many investors and there’s bidding wars!! Stay tuned to hear about seasonal and electoral changes affecting consumer confidence and financial markets. Roycroft Realty will most every week as quarterly reports are great from general news sources and from our economists, we all want more communication. |

|||||||

RSS Feed

RSS Feed